Good morning & happy Monday!

“When thousands of Global Citizens find inspiration from each other, it’s amazing to see their collective power.”

Hugh Evans, Australian humanitarian & co-founder of Global Citizen

International investing, like all investing, can be challenging at times, and it can involve a greater level of complexity, but I do not believe it is scary as it first may sound. Over the last number of years, the majority of U.S. based indexes (example: S&P 500) have outperformed international based indexes (example: MSCI Developed Emerging Markets) causing many to question if international investing is a worthwhile endeavor. Does recent performance mean we should shy away from international investing & exclusively invest in U.S. based companies? At Intentional Wealth we believe that international investments are a critical component to a well-diversified investment strategy.

As general rule most investment comparisons are made to the S&P 500, which includes the 500 largest publicly traded U.S.-based companies. This index is comprised of many of the companies we are very familiar with: Apple, Microsoft, Amazon, Tesla & Alphabet (Google) being the top weighted stocks in the index. If investing in a properly diversified portfolio there should most certainly be other asset classes included as well, international investing being a very important one. International investing usually is broadly categorized as developed markets (think Europe & Japan) and emerging markets (think Brazil, Russia, India, China & South Korea).

Now, I know right out of the gate that can sound scarry. We like to invest in what we know, and what we know is the United States of America. Ford, Amazon, Wal-Mart, Google, Apple … these are names we all know and don’t seem so intimidating to invest in. However when we start discussing foreign based companies the unknown can be quite unsettling.

International investing is probably not as foreign (pun intended 😉) as we may think. Budweiser (Belgium), BP (England), Purina (Switzerland), Frigidaire (Sweden), 7-Eleven (Japan), Bayer (Germany), John Hancock (Canada), and Hyundai (South Korea) are all companies that are not headquartered in the U.S.

My wife will may drive our Toyota van (Japan) to ALDI (Germany) to buy a Nestle candy bar (Switzerland) and call me on her Samsung (South Korea) phone to ask me if I would rather have a Popsicle (England) instead. My 3 biggest hobbies are travel, photography & sports. At my home I watch sports on a TCL television (South Korea), my camera is a Canon SLR (Japan) and when I travel I often times will stay in a Holiday Inn (England).

Maybe there “foreign” companies aren’t so foreign after all 😊

When it comes to investing international holdings add an additional layer of diversification but also additional risks and opportunities.

Now, the temptation exists for investors to say something along the lines of “US market made 20 something percent in 2021 and international emerging markets were negative 3%, why in the world am I owning international emerging markets?”

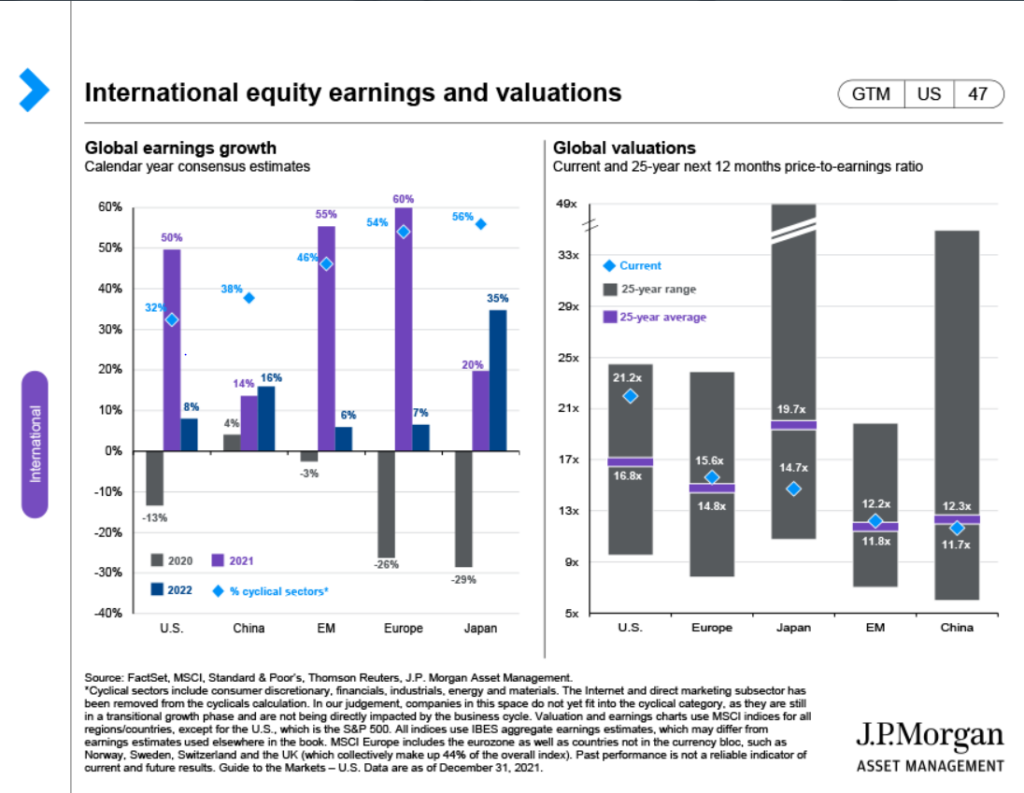

Take a look at the chart below. Under “Global valuations” on the right side you will see U.S. valuations are 21.2x P/E in comparison to a 16.8x 25-year average. Whereas EM (Emerging Markets) is trading at 12.2x valuations (vs 11.8x 25-year average). What the heck does that mean? It means international stocks are significantly cheaper than U.S. stocks are right now. As investors we want to buy companies at low prices (and sell at high prices), so internationally based companies are much more attractively priced right now.

Investing goes in cycles. There are times when the U.S. outperforms international stocks and times when international stocks outperforms U.S. stocks. 2021 was a dramatic example where we saw the U.S. investments outperform international investments, does that continue or is it’s international’s turn to outperform? I have no idea, but I know history teaches us that international investing adds value to portfolio construction long-term.

One more chart (in case you are nerding it out with me 😊). This chart shows the cycles where the U.S. outperforms international & vice versa. You will see the U.S. has outperformed international for 14.1 years (going back to 2008), but at some point that likely turns and we want to be ready to take advantage when that happens.

Last note on international (at least for today). The middle class is dramatically growing in many emerging societies. India for example has 21% of their population in the middle class as of 2020, compared to only 1% in 1995. That is projected to be 79% by 2030. (JP Morgan Guide to the Markets 12/31/2021, page 54) Indonesia, Brazil, China & Mexico all have a rapidly growing middle class as well (I’ll spare you the statistics, but if interested email me and I’m glad to provide). Side note: according to Pew research the U.S. middle class is 51% (Middle class keeps its size, loses financial ground to upper-income tier | Pew Research Center) . A growing middle class overseas likely means an increase in demand for products & services and there are plenty of companies who will benefit from those changing demographics.

Bottom line, international investing is an intentional part of portfolio construction and we firmly believe it has the potential to provide long-term value to our clients. As with all investing, it requires patience, but you’re used to hearing me say that 😉

Make it an amazing week ahead!