Good (early) morning & happy Monday!

Inflation is taxation without legislation.

Milton Freedman, economist

Inflation. We hear it talked about a lot these days. The big headline a few weeks ago was how the December inflation reading came in at 7% year-over-year, the highest such reading since 1982 (CPI Home : U.S. Bureau of Labor Statistics (bls.gov)). That means that what cost $10 a year ago costs $10.70 on average now. There are some things that are more dramatically impacted (energy prices were up 29.3% year-over-year), others are less impacted, but I think we are all feeling the effects of inflation in our daily lives. Whether at the grocery store, the gas pump or on Amazon.com it seems like the prices of everything is going up and we are all feeling it.

If you didn’t make at least 7% net of taxes on your money last year than you lost purchasing power, which should be the only real definition of investment growth.

Inflation is an enemy for every single person reading this message. Always has been and always will be.

I was born in 1980 and on my 40th birthday a few years ago my dear co-workers got me a “Back in 1980” poster. The year I was born a new home cost $68,700, monthly rent was $300, and a gallon of gas was $1.19. Today’s prices are nowhere close to those levels now … that’s inflation in real life … and it’s an ugly picture.

Let’s consider an example: Let’s say I found a great deal on a bank CD a year ago that paid 4% (good luck finding such a deal, but let’s go with it) and I put $100,000 into that CD. That means that after 1 year I would have $104,0000. Not bad, huh? Now, if I’m in a 25% tax bracket I would have to pay $1,000 in taxes (25% of my $4,000 gain) so I would have an after-tax gain of $3,000, a 3% net return. Still respectable. With inflation running at 7% what cost $100,000 a year ago would now cost $107,000. Ouch. So, in this example my $100,000 grew to $103,000 after taxes, but what cost $100,000 a year ago now costs $107,000, so after taxes and inflation I lost 4% of purchasing power. Yikes! I have more money in my account, but those dollars buy less stuff so the dollars I have are less valuable. Pretty messed up, huh?

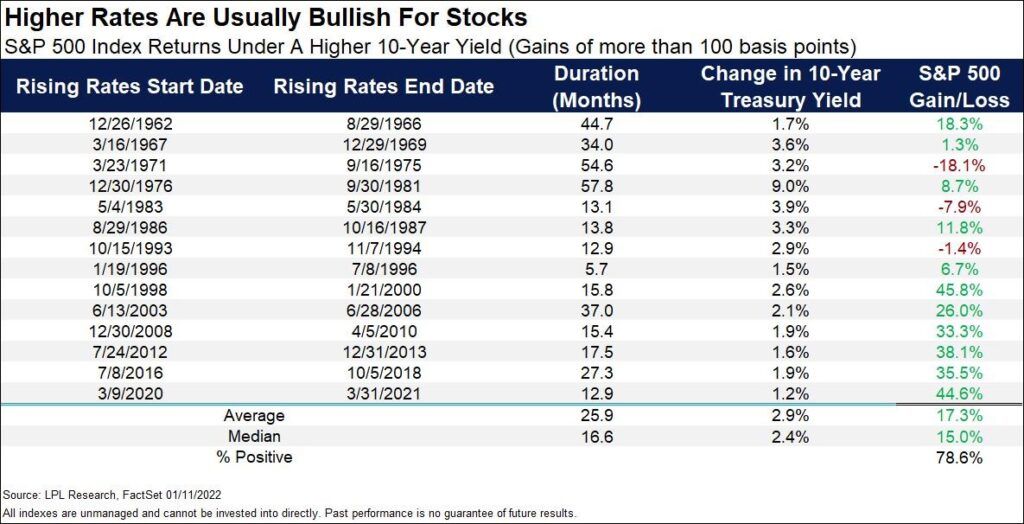

Is inflation here to stay? Is this the new normal? I do not know (and neither does anyone else). What I can tell you is that in rising interest rate environments historically equities have been a more favorable place to protect against such increases in inflation. Here’s a chart that shows the last 14 times (going back to 1962) that the 10-year treasury has increased by more than 1% and the corresponding return of the S&P 500. As you see, 11 out of the 14 times (78.5%) the market has been positive, and the average is a 17.3% gain during such periods.

Does that mean I am projecting a certain gain in the market in this current environment? Absolutely not! I am simply pointing out that even though investors generally do not like inflationary times, the equity market has responded with pretty solid growth during them. Different companies, different industries, and different countries respond differently to inflation pressure, so that is why diversification is such an invaluable tool in the battle against inflation (see 1/17/2022 Monday morning memo).

Basically, equities historically have been our best hedge against inflation. But that is also true during non-inflationary times too 😊

A very natural response to a discussion about stocks usually involves some type of statement or feeling of “but stocks are so risky.” My question: risky compared to what? I don’t want to get to far ahead of myself today, so I think I will tackle that another time 😊

In the meantime, hope you have a blessed week ahead! Please reach out with any questions.