Good morning & happy Monday (and happy birthday to my beautiful bride!)

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. They will turn away from the truth and turn aside to myths.

2 Timothy 4: 3-4

Wow … that Bible verse seems to be as true as ever in today’s world! With investing you will almost certainly always find someone who will tell you what you want to hear.

Today I want to discuss something that is very real, and likely very present in all of our lives: a concept called ‘confirmation bias.’ Confirmation bias is “the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one’s prior beliefs or values.”

I came across an interesting article in Very Well Mind (Confirmation Bias: Definition, Signs, Types, and How to Avoid It (verywellmind.com) about this topic and it lists 3 types of confirmation bias:

- Biased attention – how we selectively choose what we pay attention to – example: someone who is politically conservative is far more likely to watch Fox News than CNN or MSNBC because Fox News tells them what they want to hear

- Biased interpretation – how we interpret information received – example: someone who strongly dislikes Donald Trump will hear him make a statement and instantly dislike the statement because of existing bias against him

- Biased memory – how we selectively remember certain things and discount others – example: I totally forget when my wife asks me to unload the dishwasher, but I can remember every lyric of a song from when I was in high school (sorry honey 😉)

I don’t know a single person who is immune from confirmation bias, myself included. We all have different viewpoints and different ways of interpreting the world around us, and that can be a great thing. But this can cause all sorts of problems when it comes to investing. So, today I want to make sure I provide a warning for times in which stress levels can be high and confirmation bias can be ultra-dangerous.

During difficult or stressful times, like we are in now, we have a tendency (with confirmation bias) to put our attention, interpretation, and memory towards negative, even dooms day scenarios. “My grandfather told me about that time he lost everything in the stock market.” “That CNBC analysist said that things are going to get a lot worse and there are more losses ahead for stocks.” “I knew this would happen, every time I invest, I lose money.” All these types of statements are a variation on the same theme … pessimism.

I have met people who would call themselves optimists, but rarely do you find someone who self-identifies as a pessimist. The pessimist will instead say “I’m not a pessimist, I’m a realist.”

Pessimism is a cancer in one’s investment strategy. Pessimism leads one to believe that things only get worse from here. There are many problems we face as a nation and a world, but I can find no case for being pessimistic. We are seeing P/E ratios at very attractive levels that we have not seen in 15 years or so. We are seeing exponential growth in technology. The medical advances that are being made are nothing short of mind blowing. This is an incredible time to be alive.

Is one to believe that this is it … it’s all downhill from here? We’ve lost our nation. Businesses will stop making money. The entire global economy will completely implode. My friends, it’s not only pessimistic, it’s downright illogical.

I recently listened to a podcast where Jordan Peterson was interviewing the authors of the book “Super Abundance.” One of the authors is also a professor and he asks his students every semester “how much would someone have to give you to never use a cell phone again?” He said he’s never heard an answer less than $5 million. How incredible is that??? We are living in a time when in our pockets we have many multiples (like thousands) of the capacity we landed on the moon with, and it’s so valuable that a broke college students would not take less than $5 million to never be able to use it again. The first iPhone was released in 2007 … so in 15 years the phone has gone from not existing to something we can’t live without. Crazy!

There are not facts that will back that up long-term market pessimism, but there are plenty of facts that support extreme optimism.

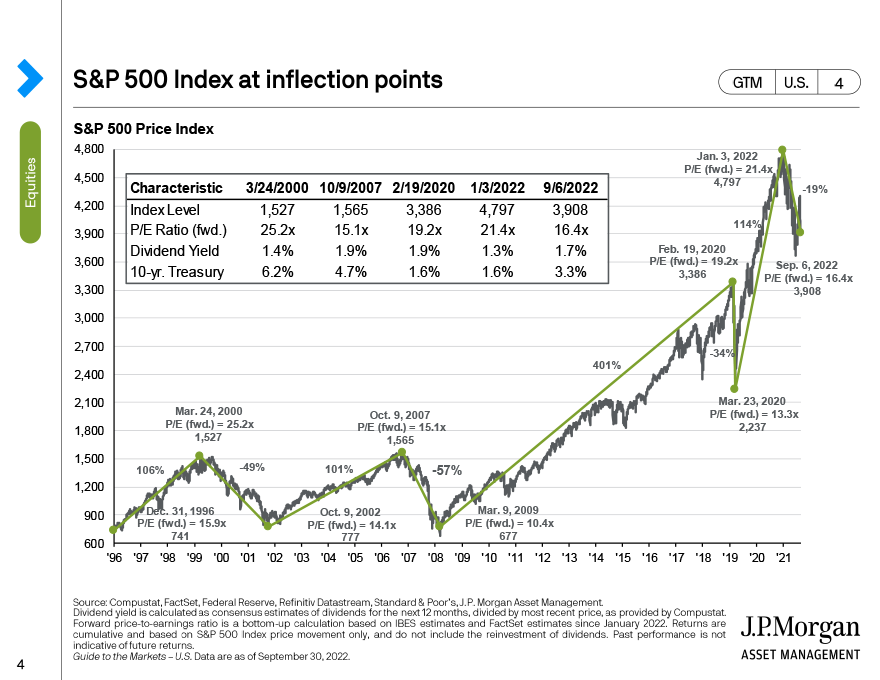

Take a look at the chart below. You will see the S&P 500 was down 19% from January 3, 2022 – September 6, 2022. You see it on the news, you see it in your portfolios, you feel it in your gut, everybody and everything is down. But, from March 23, 2020 – January 3, 2022, the S&P 500 was up 114%. Look at the data for the last 35+ years on the chart and you will see 4 series of ups (+106%, +101%, +401%, +114%) and 4 series of downs (-49%, -57%, -34%, -19%).

What has happened every single time following a market downturn? A recovery and a continuation of the long-term upward trend. The hard part is staying the course during the downturn … the hard part is now.

It is as important as ever that we fight our impulse to give into our internal pessimistic voice or allow confirmation bias to lead us into decision making. Decisions based on pessimism or confirmation bias might be correct in the short term, but rarely are they correct long term.

As equity investors this is what happens, there are times when our investments are up and there are times when our investments our down. It always has been that way and it always will be.

What’s our job during these times? It is always, 100% of the time to stick to the plan.

I have said many times before and I will say it again here: STAY THE COURSE! Do not let short-term headlines dictate investment policies that are built for long-term life spans.

It is an incredible honor to support and serve you! Make it a great week ahead!