Good morning & happy Monday,

“History must repeat itself because we pay such little attention to it the first time.”

– Blackie Sherrod, American journalist, 1919-2016

Since we are now officially just over halfway through 2023, I wanted to provide you with a mid-year update.

Before I make these comments, I would like to point out that what happens in any 6-month period of time is fairly insignificant in comparison to our objective of lifetime (and in many cases multi-generational) wealth planning. The last thing I would ever want to do is get caught up in market commentary at the expense of losing sight of our long-term financial goals. That being said, there are a number of interesting observations / learning opportunities the market has provided to us over the last 6 months. In fact, the last 18 months are ripe with lessons for all of us investors to learn from.

Friday, December 30, 2022 the S&P 500 closed at 3,839.50. On June 30, 2023 the closing value of the S&P 500 was 4,450.38. This represents a 15.9% increase in value since the beginning of the year (not including dividends).

The S&P 500 is an index of large U.S. based companies. Other asset classes such as mid-cap, small-cap, international stocks, etc. all had different returns, but for this conversation I will focus on the S&P 500 as that is often considered the best broad-based market index.

So, we had a very solid first half of 2023. This is not particularly surprising if you ask me.

Why? The very simple fact that the market losses from last year made stock ownership available at an attractive discount to investors. So, the buyers come in to scoop up cheap stocks, like they have every other time stocks become overly discounted.

January 3, 2022 the S&P 500 closed at an all-time high: 4,796.56.

159 days later, on June 13, 2022 the market officially entered a bear market (defined as a 20% drop from a previous high), with a closing price of 3,749.63 that day.

The bottom of this market cycle was 121 days later on October 12, 2022 where the S&P 500 closed at 3,577.03.

In the 280 days from January 3, 2022 to October 12, 2022 the market had lost 25.4%.

Let’s pause right here for a moment. October 12, 2022 was 271 days ago. What were you doing on that day? I had to look at my calendar to see what I was doing that day. My guess is that you don’t have a specific recollection of that individual day either. There was no public service announcement “Today is the low point in the stock market, tomorrow starts a new bull market.” There was no airplane skywriter saying “BUY TODAY.” I don’t recall seeing any billboards going up saying “This is the moment you buyers have been waiting for.”

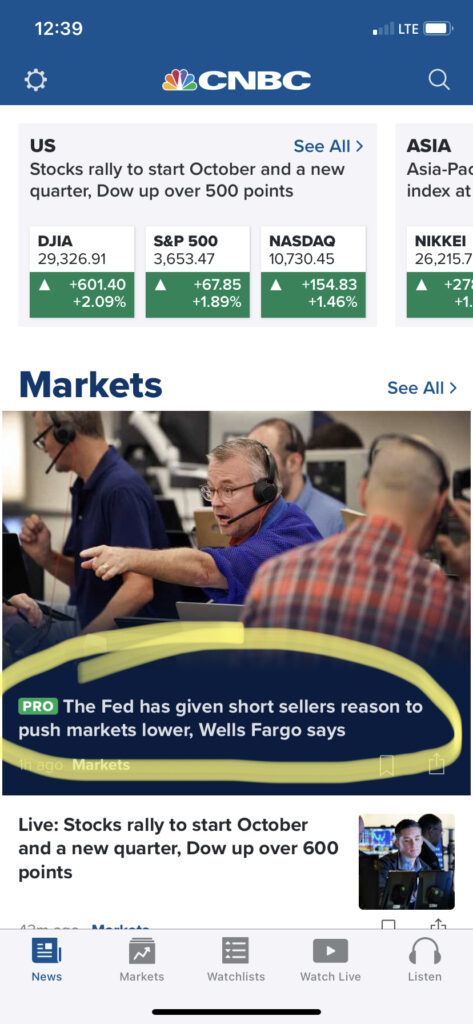

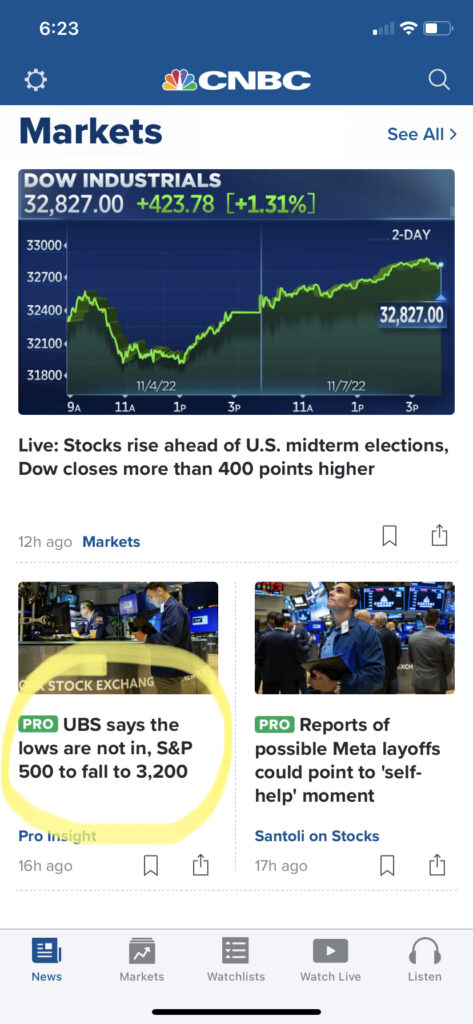

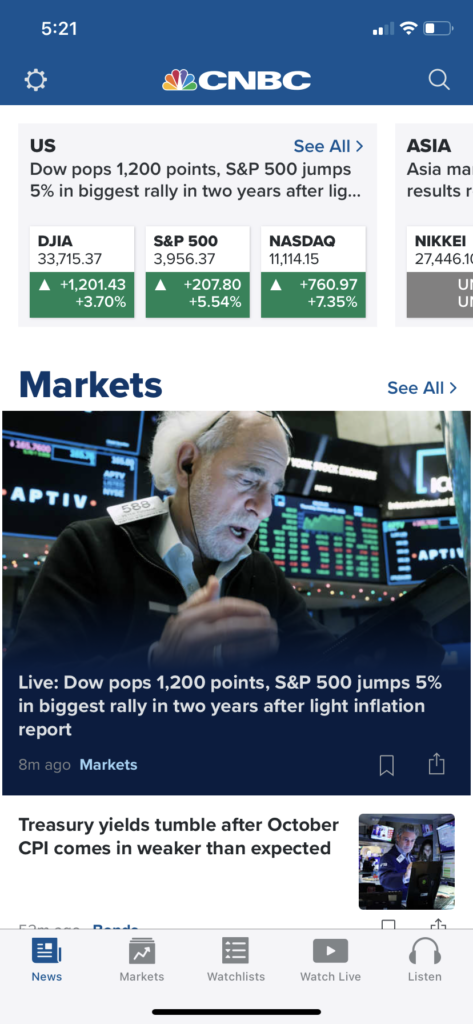

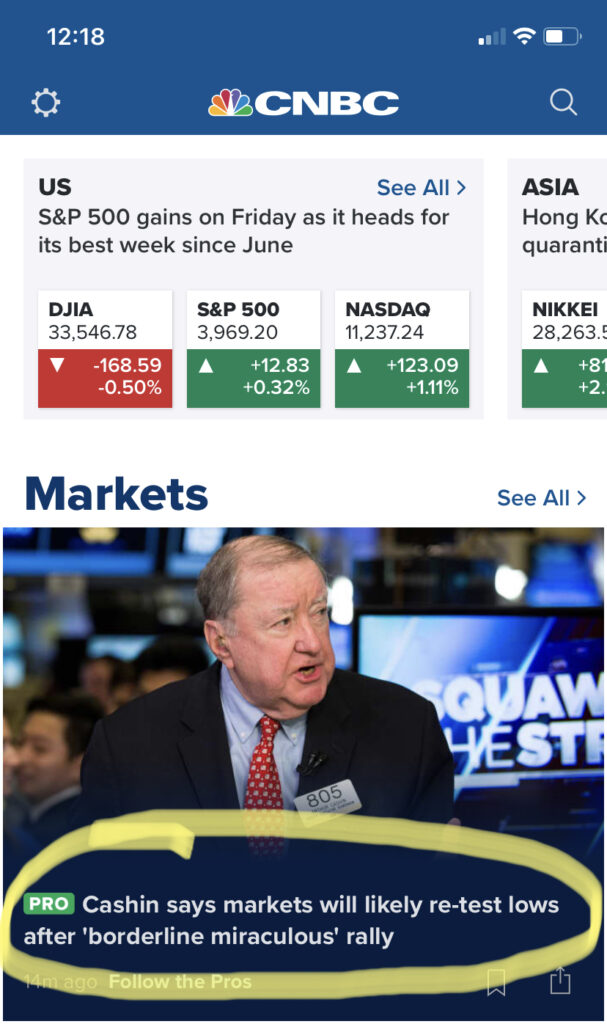

I periodically take screenshots of market headlines, basically because I get a kick out of how wrong all the market gurus and media talking heads constantly are. I went back through my photo album on my phone and searched for screenshots I took closest to the October 12, 2022 market low. All these attached screen shots are from the CNBC app. October 3, 2022 (9 days before market low): “The Fed has given short sellers reason to push markets lower, Wells Fargo says.” November 8, 2022 (27 days after market low) “UBS says the lows are not in, S&P 500 to fall to 3,200.” Two days later, November 10, 2022 “Dow pops 1,200 points, S&P 500 jumps 5% in biggest rally in two years after light inflation report.” The next day (November 11, 2022): “(Art) Cashin says markets will likely re-test lows after ‘borderline miraculous’ rally.” It’s amazing how consistently wrong these people are and yet people still listen to them. That’s a whole other topic worthy of its own Monday morning memo! Be forewarned 😉

By November 10, 2022 (a mere 29 days from the October 12, 2022 low), the S&P 500 closed at 3,956.37, above the June 13, 2022 close that officially started the bear market.

Last month, June 8, 2023 to be precise, the S&P 500 officially entered a bull market (defined as a 20% increase from a previous low) with a close at 4,293.93.

Through June 30th the S&P 500 is up 24.4% from its low point on 10/12/2023 (again, not including dividends).

Two quick observations I think it would be likely for you to point out:

- “What about dividends?” All of these S&P 500 values exclude dividends which, as you know I talk about frequently, are a very important component of investing. These losses over the last 18 months are less when you factor in dividends.

- “If the market went down 20% and then up 20% why are we not back to break even?” This is a great observation and one I’ll plan on addressing in more depth in next week’s Monday morning memo. But bottom line: ups and downs are not equal in investing. Stay tuned for next week. 😊

What are the lessons we can learn from these last 18 months?

- Be patient – successful investing requires patience, there is no substitute for patience. I am not a patient man, I hate waiting in traffic, in grocery store lines, anywhere … but in investing is basically a requirement.

- Be diligent – this means tuning out the noise that is all around us … the financial news media, the neighbor who has the market all figured out, the email your distant cousin forwarded to you telling you to sell all your stocks and buy gold. Sticking with the plan even when it’s not easy is key for us investors.

- Be wise – I’ve had many conversations where I discuss the “head vs. heart.” The head (the logical part of us) says in a down market “be patient, be diligent, this too shall pass” while the heart (the emotional part of us) is screaming “you’ve already lost 20%, stop the bleeding and get out before you get killed!” Listen to your head.

It’s a tremendous honor to have served you these past 18 months as we have navigated these waters. We will continue to work as hard as we know how to provide you with the best guidance possible going forward as well.

At any point during the journey please do not hesitate to reach out to us if we can support you further.

Make it a great week ahead!