Good morning & happy Monday!

“We are choked with news and starved of history.”

– Will Durant, American historian, 1885-1981

The headlines are busy these days! Lots to talk about. Lots to worry about.

Just in this last week we had the Fitch rating agency downgrade the U.S. credit rating, the current president of the United States under increasing suspicion of being involved in some very shady foreign business dealings, and another indictment of the former president of the United States (something that seems to occur almost weekly these days). This is on top of ongoing news stories of inflation, Russia / Ukraine, rising fuel prices, interest rates, Fed policy, and recession fears.

What are we as investors to do?

Here’s my recommendation: nothing.

That’s it? Here it seems the world has lost its freaking mind and Jonathan simply says “do nothing.”

Yep!

I know it can sound crazy, but this is by far the sagest advice I can possibly give.

DO NOT REACT. We are proactive investors, not reactive traders!

When my children were toddlers, they would sometimes throw one of those classic temper tantrums. My job as a parent was to remain calm because if I started screaming at the same level then the entire house would turn to chaos. Many time my best strategy would be to just walk away.

Same general concept in investing. If the financial news media is throwing a temper tantrum, just turn it off and walk away. 😊

This morning I would like to draw some attention to a fairly well-known fact in my industry that I don’t believe I’ve specifically addressed. Take a look at this chart (also attached as a PDF):

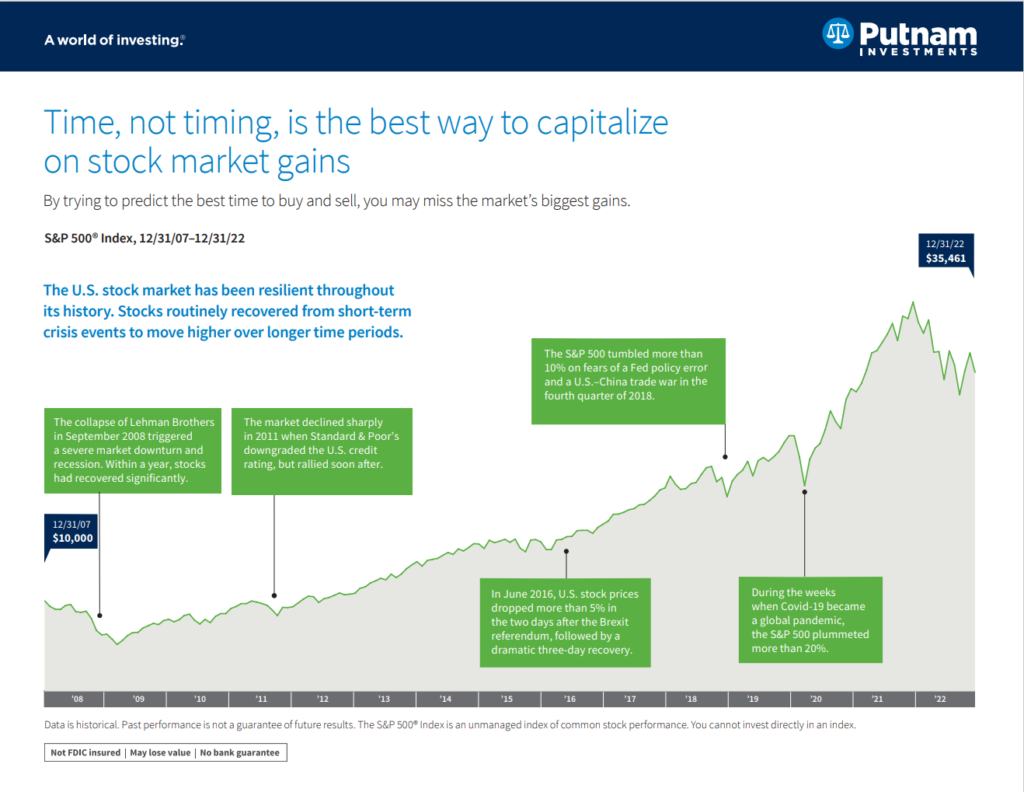

This first page shows the S&P 500 over the 15-year period of time from 2008 – 2022. This specific period of time includes 3 major market pullbacks: 2008 Great Recession, 2020 Covid flash-crash, and the challenging year 2022 was. If you are trying to convince someone to invest, this would not be the 15-year period that you would pick … precisely why I like to use it here. 😊 This chart starts with a market pull back in 2008 and ends with a pullback in 2022 (it does not factor in the so-far solid year of 2023).

Quick note here, and then I’ll move on. Look at the 2nd green box: 2011 when S&P rating agency downgraded the U.S. credit rating. Now in hindsight it was simply a blip on the radar. Don’t lose sight of history, it teaches us a lot!

Ok, moving on, take a look at the 2nd page …

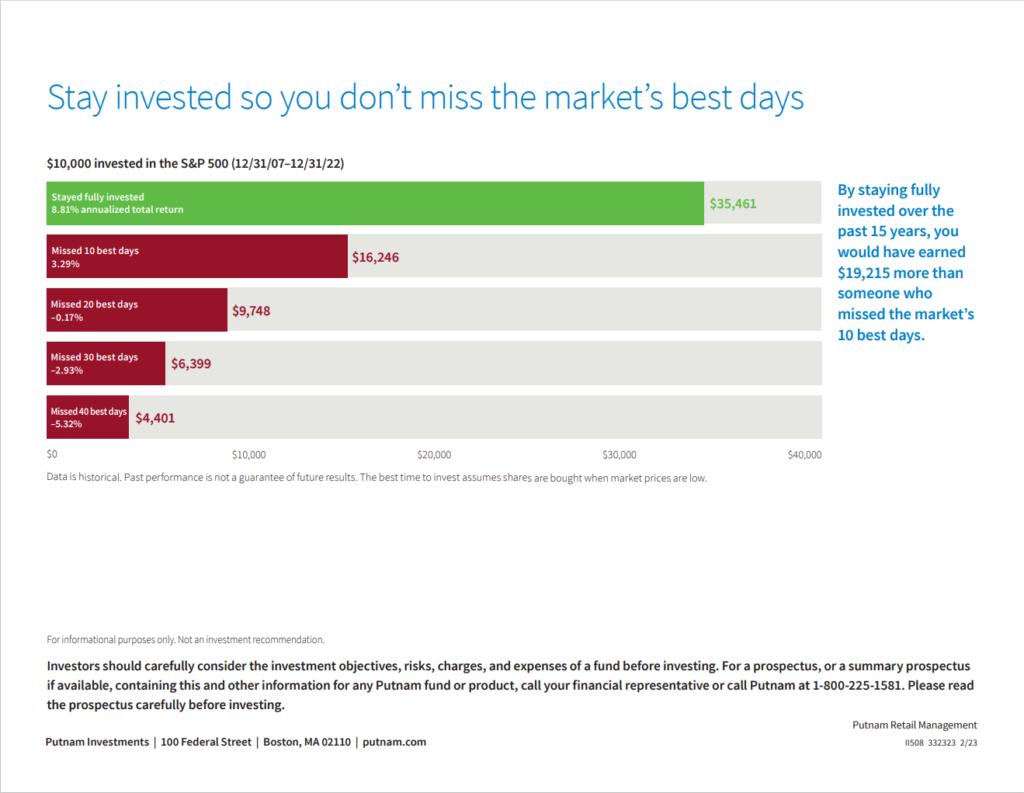

Here you will see that over that 15-year period of time from 2008 – 2022 the S&P 500 averaged an 8.81% rate of return. That seems really solid, especially since there were 3 bear markets where the S&P 500 lost more than 20% of its value each time.

But what if you missed only the best 10 days during that entire 15-year period of time? Your return would have gone from 8.81% to 3.29%

If you missed the 20 best days, your rate of return was actually negative during that 15-year period!

Just let that sink in for a moment … the stock market is open roughly 250 days a year (actual average is 252, but who’s counting), so in a 15-year period there would be 3,750 trading days (250×15). Missing 10 of them would have cut your return by more than half (8.81% to 3.29%) and missing 20 would cause your rate of return to be negative 0.17%.

I don’t know of a better illustration for combating the notion that we all sometimes feel in our gut “things are just too crazy now … let me get out of the market and I will get back when things settle down.” You don’t have to sit on the sidelines for too many days to have that be a very costly mistake!

Take a big, deep breath and stick with the strategy! We as investors are rewarded for discipline, diligence, and patience. Please don’t ever lose sight of that. One of my most important jobs as your financial planner is to make sure to keep this message front and center (Heaven knows the financial news media never will).

In this journey of life and investing I am so grateful to be walking alongside with you. Please never hesitate to reach out with any questions or ways that my team and I can support you.

Make it a great week ahead!