Good morning & happy Monday!

“When things go badly, people become cautious. Then their caution causes things to go well, and when things go well, they become incautious. I think that’s a forever cycle.”

– Howard Marks

So, I know the market has been a bit busy recently. As I mentioned last week, the S&P 500 was down about 8.5% from July 16th to August 5th.

This is no cause for concern and is totally normal. It’s just called investing. I know I’m repeating myself from last week, but it’s such an important point I feel it bears repeating.

There have been 9 trading days since August 5th, 8 of them have been positive (including every single day last week) and we are now only about 2% away from the S&P 500 all-time high on July 16th of 5,667.20.

Despite how you may feel, the market looks forward and really only cares about future corporate profits. Since corporate profits generally are increasing the stock market will generally increase too. But that most certainly does not mean it will be a smooth ride.

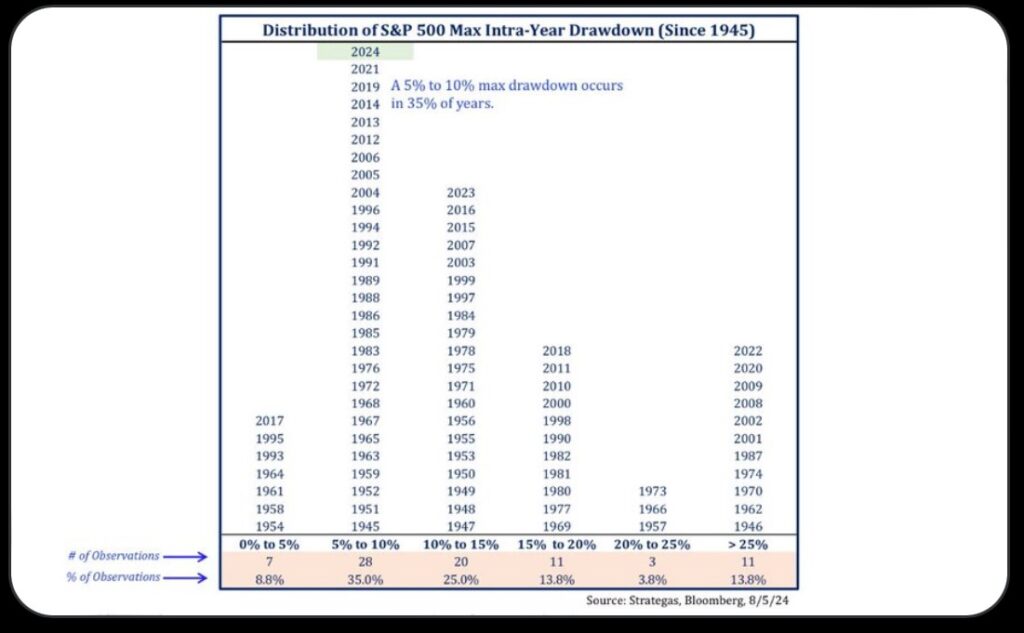

Check out this fascinating chart below:

This chart shows how many times from 1945 to 2024 (80 years of data) the S&P 500 was down 0%-5%, 5%-10%, 10%-15%, 15%-20%, 20%-25%, and 25%+.

Well, low and behold, the most common occurrence during this 80-year period was a drop of 5%-10%. That happened 28 out of the last 80 years (35%), including this year of 2024. It’s totally and completely normal and no cause for concern at all.

In fact, I would like to dive into this chart a bit more because there are many valuable lessons to take away.

- Low volatility years, where the S&P 500 is down less than 5% during the year only has occurred 7 times in the last 80 years, a mere 8.8% of the time.

- We as equity investors should never expect low volatility. It rarely happens.

- 11 times since 1945 (13.8% of the time) the S&P 500 has dropped by 25% or more. 2 of the last 5 years (2020 & 2022) we have been here.

- This is never fun but is well within the normalcy for stock market investing. When it happens, it tends to open the door for significant gains in the future. In other words, don’t freak out, see it for what it likely is: a buying opportunity

- Oversimplifying this chart, roughly 2 out of 3 years (68.8% of the time) we see drops off 15% or less in equity investing and 1 in 3 years (31.2%) brings a drop of more than 15% at some point during the year.

- Simply put: it’s quite common to have volatility in your investments.

This financial world can be very complex, but a key principles for equity investing is actually very simple: we as equity investors have historically been very handsomely rewarded because we can ride out the ups and downs that stock market investing brings … if it were easy everyone would do it … if the ride was smooth everyone would want a seat on the ride.

But, it’s not easy and it’s not a smooth ride … the ride can be bumpy and unenjoyable at times. Rather than begroan or stress about this fact, I would encourage you to embrace it. These market corrections are WHY you can become so wealthy as an investor. So, I will boldly say, “Bring on the volatility!”

Now, I’m not naive enough to think you will get excited about market volatility, but I hope these words put that volatility in perspective and allow you to take a deep breath and realize it’s perfectly normal and an expected part of your investing journey.

Thank you for allowing me to be a part of it.

Please never hesitate to reach out if there are any ways I can support you along your journey.

Make it a great week ahead!