Good morning & happy Monday!

“May all your troubles last as long as your New Year’s resolutions.”

– Joey Adams, comedian 1911-1999

Now that 2024 is a memory and we are almost 2 weeks into 2025 I wanted to take a chance to discuss what happened in 2024 and lessons we can learn from the year.

Overall, 2024 was a fairly solid year for equity investors.

The S&P 500 was up 25%, the Dow Jones was up 15% and the NASDAQ was up 29.6%.

9 out of the 12 months of 2024 saw a positive return in the S&P 500.

2024 also saw significant concentration in the S&P 500 with the top 10 stocks accounting for 38.7% of the total value of the index, an all-time high. In other words, the top 10 companies in the index of 500 are worth over 1/3 of the total value.

Small cap stocks with up 11.5% and developed international markets and international emerging markets were up also, but by a more modest 4.3% and 8.1% respectively.

2024 was a bit of a frustrating year for bonds as yields moved around quite a bit. US bonds (AKA fixed income) were minimally higher with a 1.3% return in 2024.

We started 2024 with the 10-year U.S. treasury, probably the best benchmark of interest rates (I’ll dive into this more another week) at 3.86% and by 12/31/2024 it closed at 4.57%.

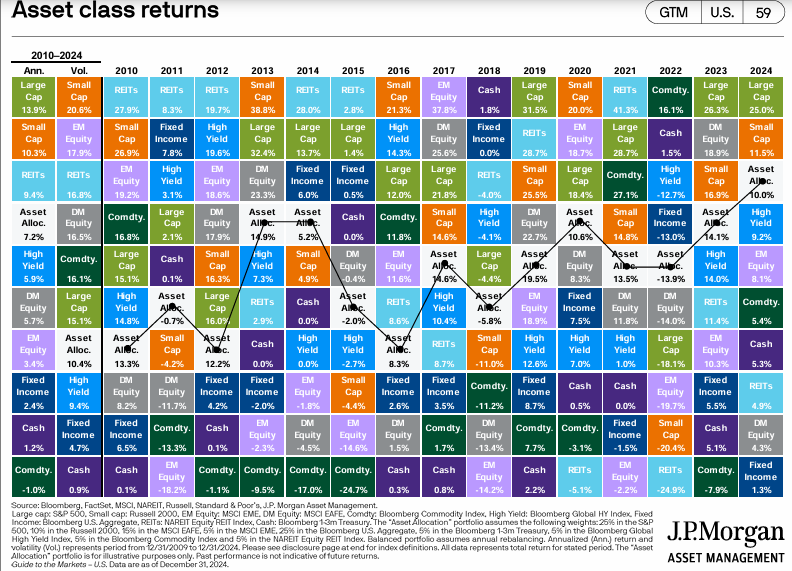

Here is a chart that shows asset classes year-by-year for the last 15 years (2010-2024):

What you will likely notice is that there is no particular pattern that develops, besides that fact that the white box “Asset Alloc” is in the middle, as that is a diversified portfolio of a mix of all the other boxes.

Some years are really good for most asset classes (2019), some years are bad for most asset classes (2022), and most years it’s a mixed bag of good and bad.

You will see from the chart above that 2024 was one of only 5 years in the last 15 where there were no negative asset classes, so that’s a positive. You will also see that cash returns were attractive in 2024 in comparison to the previous 14 years, which has advantages and disadvantages that I don’t have time to dive into today … maybe some other time 😉

Some companies and industries thrived, some massively struggled.

The best performing stock of 2024 in the S&P 500 was AppLovin with a 712.62% return in 2024. The other top performers were MicroStrategy (+358.54%), Palantir Technologies (+340.48%), Vistra Energy (+261.32%) and Robinhood (+192.46%)

Walgreens was the worst performing stock in the S&P 500 in 2024 with a 61.39% loss. Other big losers include Intel (-59.56%), Moderna (-58.19%), Sirius XM Holdings (-56.94%), and Celanese (-54.57%).

So, what caused these results to happen?

Well, as is almost always the case there are many multiple factors, but 2024 saw the long-awaited economic slowdown not materialize and instead saw a stabilizing economy.

Markets oftentimes price in what-if scenarios … and when those scenarios don’t materialize the markets adjust accordingly. For much of 2023 the talk was about the pending economic slowdown, but when that didn’t actually turn out to be the case over 2024 the market breathed a sigh of relief and drove higher.

Other major factors that affected 2024 returns included 3 Federal Reserve rate cuts totaling 100 basis points (1.00%), the frenzy of excitement around Artificial Intelligence (AI), and the election of Donald Trump.

Ok, so I know that’s a ton of information. Thanks for sticking it out with me. I want to keep you up-to-date and informed, but I never want data, charts, returns, or analysis to distract us from what’s most important … staying focused on your goals.

No matter what 2025 brings, I will continue to prioritize and emphasize the importance of goal-clarity, discipline, and patience over short-term market movements, news headlines, or whatever chaos is coming out of Washington.

I am so unbelievably grateful to partner with you and I am looking forward to what 2025 and beyond brings.

Please let me know if there is anything we can do to support you along the journey.

Make it a great week ahead.