Good morning & happy Monday!

“Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things”

– Charlie Munger, vice chairman of Berkshire Hathaway (Warren Buffet’s company)

Two weeks ago I bombarded you with tons of bullet points about the SECURE 2.0 Act that passed in late December 2022. That act was part of the omnibus spending package with a price tag of $1.7 trillion.

I know we can all become exceptionally frustrated with our government and the tremendous amount of spending (oftentimes wasteful in my humble option) they undertake … trust me, it’s a topic that can get me quite fired up! Today instead of talking about spending I would like to address the power of savings … something I think our government does not really understand 😉

More specifically I would like to address one of my favorite economic principles: compounding interest!

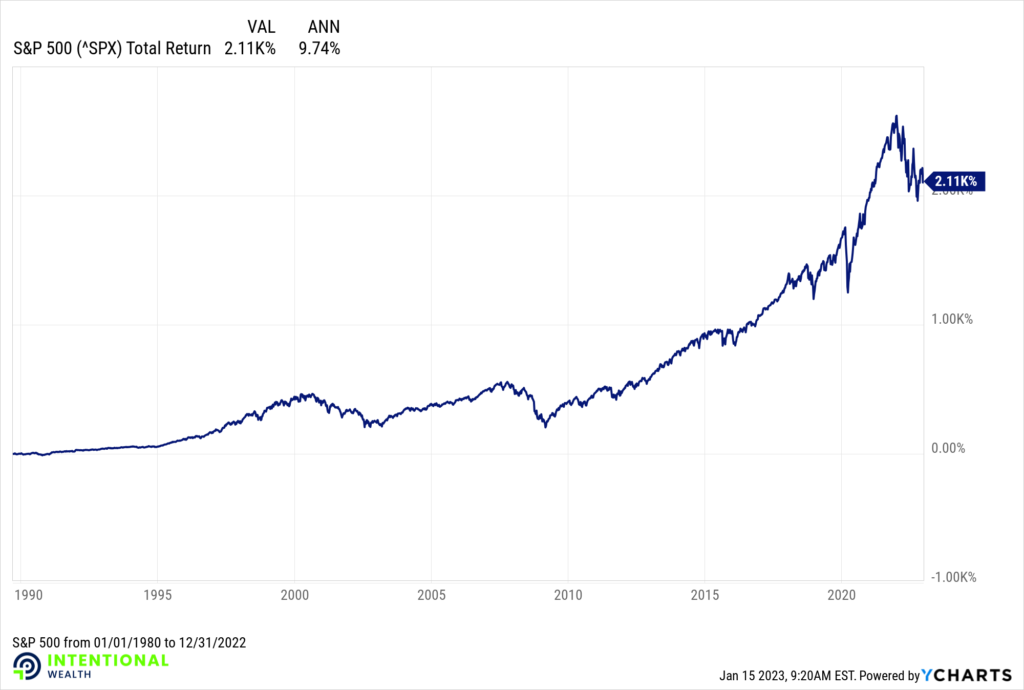

Earlier this month I turned 43 years old (not sure while the official line is for middle age, but I digress 😉). Since my birth month of January 1980 the S&P 500 is up more than 2,110%. From 1/1/1980 to 12/31/2022 the S&P averaged a 9.74% average return (see attached chart).

9.74% average annual return sounds cool, but a lifetime 2,110% return sounds incredible. How does that happen? The answer is beautiful compounding interest!

Let’s look at an example to hopefully bring this concept to life:

Let’s assume I start with $1,000 and that it grows by 9% per year. Just so we are clear, this is simply an illustration and math calculation … this is not a recommendation, a prognostication, or a product presentation … just a numbers nerd and a financial calculator 😊

That $1,000 is worth $1,090 at the end of the first year with a 9% return. That’s cool, but what happens after that is the full balance of $1,090 is now growing, so my growth is growing. After the second year my balance is $1,188.10 (9% growth on $1,090).

Early on compound interest is neat and fun but given time it becomes HUGE.

- 10 years of 9% annual growth means that my $1,000 is worth $2,451.36

- After 20 years my initial $1,000 is worth $6,009.15 with a 9% annual growth rate

- In 30 years, its value is $14,730.58

- 40 years later it’s $36,109.90

- By the end of year 50 that $1,000 is worth $88,518.26 in this example!!!

Wow!

Early on it was not that exciting (making $90 on $1,000 in the first year) but in the later years it gets super powerful ($52,408.36 in growth from year 40 to year 50)

Let’s take this just a step further and go for a 90-year lifetime:

- 60 years later than original $1,000 is worth $216,989.87 at a 9% annual growth rate

- At the end of year 70 we are looking at $531,919.66

- At the conclusion of 80 years the value is $1,303,925.03

- And check this out … at the end of the 90th year the value is $3,196,385.84!

So, in this hypothetical example, if someone gave a newborn baby $1,000 and made a 9% annual compounded growth rate, and that child never touched the funds and died at age 90 the $1,000 would have grown to over $3 million! See why I love this principal so much!!!

My friends, that is the power of compound interest. Understanding this principal is life changing 😊

Thank you for allowing me to help you in putting this principal to work for you. As always, please never hesitate to reach out with any questions.

Make it a great week ahead!